Mining Contracts and Mining Hardware, analyzed

Quebex has created a mining profitability calculator that we hope you'll find much more accurate than the crudely constructed (or purposely misleading?) calculators popular on the internet and in search engine indexes.

First, an explanation about what makes it different:

- We calculated blockchain difficulty rate of change over the previous 12 months, set that as the default, and provided a mechanism for users to adjust how much new hashing powers they expect to see join (or leave) the bitcoin network.

- Bitcoin prices aren't stable. Bitcoin is well known for its volatility. And so, we allow users to test the effect of different market performances on their bottom line.

- How much bitcoin users pay in transaction fees directly impacts the reward for miners, so we let you play with that.

- The next halving is a while away, but it's still an eventuality. The calculator assumes block rewards will halve in mid 2020, and adjusts payouts accordingly.

- "Nothing lasts forever", and so you should plan for hardware failures. We added a slider for that, too.

- Most importantly, we show you what your profit margin would look like if you bought bitcoin and left it in your account rather than sending it away for a mining contract.

How to read the report

There are a variety of columns on the report. Here's a quick explanation for each:

- When: The projections are made 1 month at a time. This column shows the effective date for the projection.

- Costs: Whether it's contract maintenance or a bill for consumed kWh, mining is almost certainly going to have some kind of ongoing costs. This shows, in BTC at the then-current projected market rate, what those costs amount to.

- Payout: Hopefully, mining will produce some sort of reward. Assuming 'fair average payout from a mining pool with no fees', this is a projection of how much BTC you should receive given your stated hashing power and the projected difficulty increase at that time.

- Profit: Payout minus Costs equals Profit. Simple enough.

- Cumulative: What do all those profits amount to, over time?

- Net BTC: Assuming you paid the initial purchase price with BTC (or 'buying btc' with the money was the forgone investment option), you start with a significant negative Net BTC total. As you profit, that profit is added to your Net BTC total to track when you would get your original BTC back.

- Net $: The counterpart to Net BTC is Net $. You start off at a loss of what you paid for the hardware/contract. As BTC come in, the amount you would get selling them at that point is added to Net $.

- Vs. Holding BTC: Had you taken your money and invested in bitcoins, and you never sell them, how much would those bitcoins be worth at that point in time?

Some scenarios

Wondering what would happen if you bought a 0.2 TH/s contract from Genesis Mining for $30 USD?

The result? Holding on to bitcoins was wildly more (and actually) profitable.

But how realistic is a $5, 600/BTC price by 2018? We express no opinion on that matter.

Wondering what would happen with no change in BTC price?

That's no better for mining's reputation. If the bitcoin price doesn't rise, within a year it stops being profitable given historical rates of growth.

So if no increase in price results in an early end to the contract and a net loss, and growth at the current rate shows holding bitcoin being far more profitable, then what happens if bitcoin actually gets even more valuable, even faster?

If bitcoin doubled its rate of growth (15% rather than the 7.8% we've seen) things would be absolutely wonderful!!! (for people who bought bitcoins, not a contract, that is)

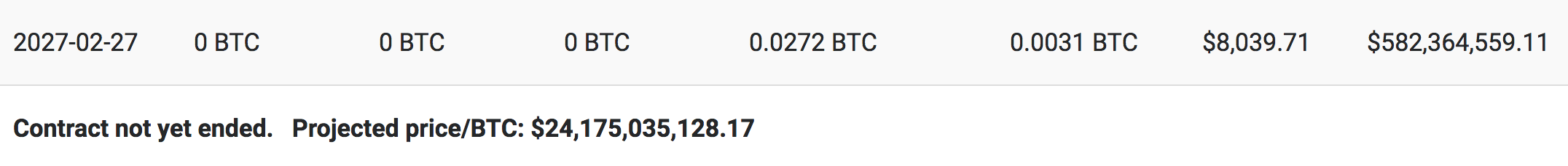

Sure, a contract would net you a profit of over $8, 000 but that's nothing compared to the half a billion dollars that holding the bitcoin would provide.

24 billion dollars for a bitcoin. What a world!

Maybe we're ignoring bitcoin's promised future. A future where miners are rewarded from transaction fees and not from block rewards. A future where the halving of block rewards isn't as significant. We considered that too.

So what would mining look like if there was 6 BTC in fees per block? Not so bad, comparatively. $67.87 profit by contract end from an original investment of $30. It's no $658 from holding BTC, but it's still over 200% ROI. Of course, that requires a price of over $27, 000/BTC. Shame that when the block reward halved it would be over.

You might be asking yourself what if noone else ever starts mining from this point on, but bitcoin keeps getting more profitable?

I think we've figured it out! The holy grail of bitcoin mining profitability! If you can just convince everyone else in the world that they shouldn't start mining,

so the difficulty never changes, and at the same time convince everyone that bitcoin is great and its value should continue to go up at a rate many times higher than inflation you'll be set.

If the price of 1 bitcoin goes up to 10 million dollars, you'll have about a quarter million dollars in bitcoin 10 years from now!

We were a little skeptical of a 10 million dollar valuation for a bitcoin, so we considered a small increase in hashrate with half the rate of bitcoin price growth.

So how does bitcoin mining fare? Well, after 10 years, with a projected bitcoin price of $124, 000/BTC, a $30 investment in a mining contract could net you a net profit of $390 after the 10 years. that's 1300% more than the investment!

Will bitcoin actually hit $124, 000/BTC after 10 years, and see virtually no new additions of hashing power to the network in that time? We suspect this to be a failry unlikely scenario, but are not in the business of giving investment advice.

But we will give you the tools to understand what a bitcoin mining contract investment would require to be more profitable than simply holding bitcoin: virtually no new entrants competing with new hashing power, a continuous rise in bitcoin prices, and a significant uptick in the fees paid by users of bitcoin to the miners.

Though there are many people with something to gain from their stories being believed telling tales of a future where users pay the miners, there really are no guarantees mining will be profitable going in to the future--only past performance of the crypto currency which predicts the opposite to be the case.

Canadians With Funds in Quadriga CX unable to withdraw

Bitcoin futures debut in US market

One BTC is currently trading at $21,080.29 CAD, on average, as of 12pm, ET, per CoinDesk, having hit a Read More...

Vulnerability in Wi-Fi protocol affects many competitors

This comes only months after reports of the BlueBorne flaws affecting nearly every Read More...

Quebex Backs the Winning Fighter

As such, Quebex was pleased to sponsor Mazlum Akdeniz in his debut fight at Montreal Casino.

Though his opponent danced around the Read More...

Quebex Response to User Activated Hard Fork

Bitcoin will continue to exist. A new cryptocurrency will emerge called Bitcoin Cash (BCC), and the general Read More...